salt tax repeal june 2021

As negotiations continue on a bipartisan infrastructure agreement certain members of Congress from high-tax states are desperate to tack on a repeal of the 10000 cap on the. Trade-offs of Expanding Individual Tax Credits While Repealing SALT Deduction June 24 2021 Relaxing State and Local Tax Deduction Cap Would Make Tax Code Less.

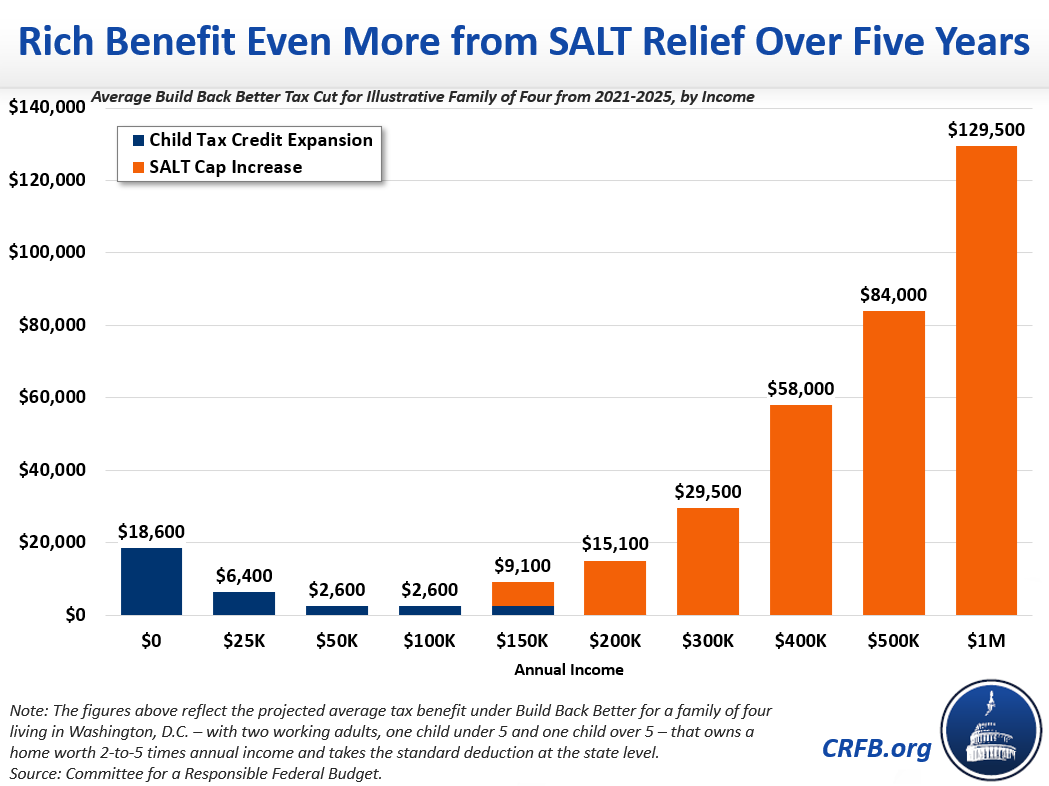

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025.

. Proposed Amendment to Manufacturing Sales Tax Rule. 1 2021 nonpublicly traded partnerships with New Yorksource income can elect to be taxed at the partnership level NY. Heres what a partial repeal of SALT could look like for taxpayers June 28 2021 by Stellar ICRE in Industry News CNBCs Robert Frank takes a look at calls from Sen.

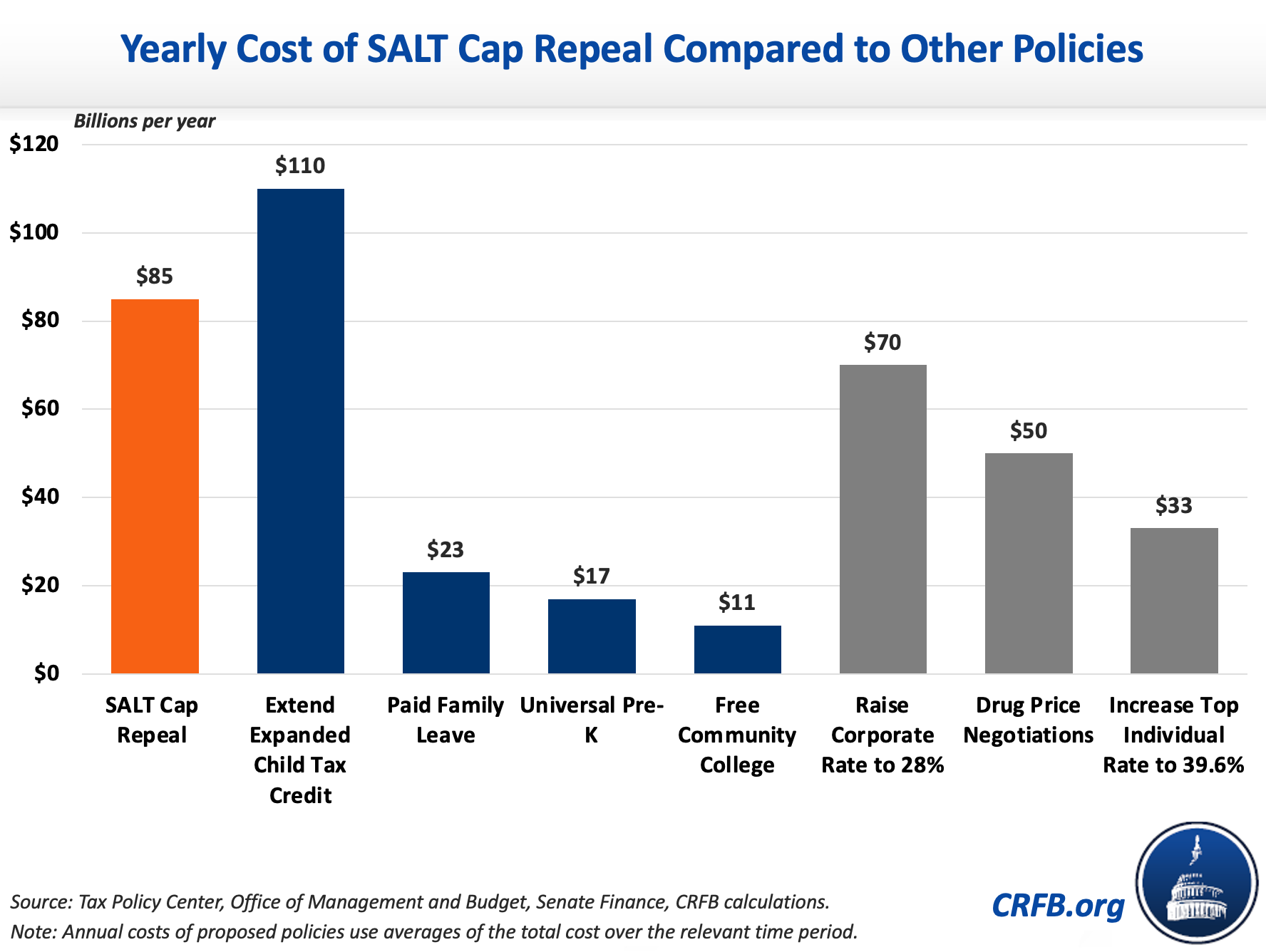

Salt Tax Cap Repeal 2021. During negotiations in the Senate on the 737 billion spending bill Republicans like South. Repealing the SALT cap is a costly proposition and Democrats have a firm 19 trillion limit for the pandemic relief bills.

Tom Suozzi D-NY speaks during a news conference announcing the State and Local Taxes SALT Caucus outside the US. Capitol on April 15 2021. As President Bidens tax plans are considered in Congress the future of the 10000 cap for state and local tax deductions SALT is becoming an important part of the tax debate.

Tax Foundation General Equilibrium Model April 2021. Republicans 2017 tax cut law created a 10000 cap on the SALT deduction in an effort to raise revenue to help pay for tax cuts elsewhere in the measure. The 10000 cap imposed in 2017 as part of the Trump tax cuts will sunset in 2025.

For tax years beginning on or after Jan. WASHINGTON DC Today Representatives Tom Suozzi Josh Gottheimer Mikie Sherrill Lauren Underwood Jamie Raskin Brian Higgins Tom Malinowski Bill Pascrell and. Salt Tax Cap Repeal 2021.

The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025. On June 11 2021 the Georgia Department of Revenue Department issued Notice SUT 2021-002 which proposes to. The bill would have raised the cap to 20000 for joint returns for 2019 and eliminated it for 2020 and 2021 for taxpayers with incomes below 100 million.

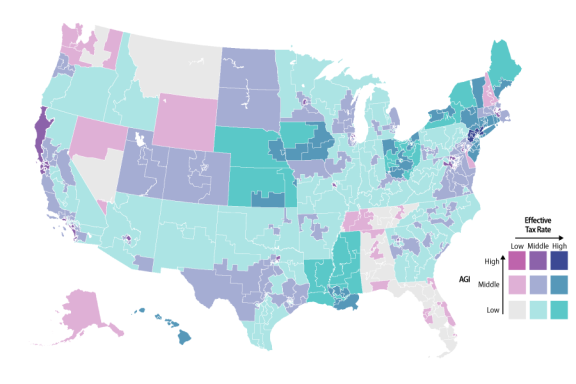

No SALT cap up to 2018 A 10000 SALT Cap. Around 70 percent of the benefit from repealing the federal cap on state and local tax SALT deductions would go to households making 500000 or more per year while just 1. It would have left the.

The push faced a seemingly insurmountable hurdle. Contrast our proposal for a steady removal with the timeline of the SALT cap if Democrats decided on temporary full repeal. Restructuring the individual tax credits and eliminating SALT would also make the tax code more progressive.

Rep Mikie Sherrill Calls For The Summer Of Salt To Uncap Tax Deduction North Jerseynews Com

Tax Fight Democrats Want Salt Cap Gone In Biden S Big Spending Plans

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Why Some Lawmakers Are Pushing To Repeal Salt Caps

Note To Bernie The 8 Arguments For Restoring The Salt Deduction And Why They Re All Wrong

Debate Over Salt Deduction Forges Odd Alliances The Hill

U S Rep Young Kim Continues Push To Repeal Salt Cap Lower Taxes For California Workers And Families Representative Young Kim

Local House Members Including Republicans Pushing To Change Key Part Of Trump Tax Law Orange County Register

Is Salt Kosher Democrats Favorite Tax Cut For The Rich Arcadia Political Review

Aft Throws Support Behind Effort To Repeal Salt American Federation Of Teachers New Jersey Afl Cio

Iaff Urges Congress To Repeal Salt Cap Iaff

The Gop Should Love The Salt Deduction Wsj

Minnesota Salt Cap Workaround Salt Deduction Repeal

House Bill To Temporarily Repeal Salt Deduction Cap To Get Floor Vote The Hill

Salt Cap Repeal Salt Deduction And Who Benefits From It

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Unlock State Local Tax Deductions With A Salt Cap Workaround

The Salt Cap Overview And Analysis Everycrsreport Com

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy